As part of our series on Nigerian FinTech start-ups, we bring you all you need to know about Flutterwave.

In a highly digitalised world, commerce is becoming increasingly electronic. This means that there is a greater demand now than ever for electronic means of buying and selling of goods and services, also known as e-commerce. One of the most important tools needed by every e-merchant is a payment gateway.

A payment gateway is a route through which payment is received and processed by a merchant on behalf of their customer. It allows the seller not only to display the services on offer but also provides a means for customers to electronically make purchases of goods and services.

In the past, people looking to sell products have had to come up with different ways to take payment from their customers. In addition to this, businesses that scaled up in value also had to worry about account reconciliation.

With payment gateways or channels, however, users can easily make purchases and the seller is guaranteed to receive his payment electronically. All payments are also made into a designated central account, meaning less hassle. This is usually done quite seamlessly—mostly by the integration of their APIs into your website or app.

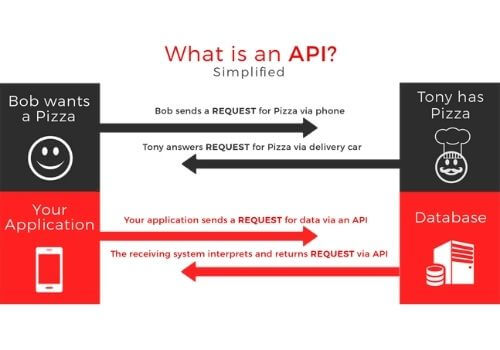

What is an API?

API stands for Application Programming Interface. The term API (in the context of our discussion) is a set of functions, procedures, methods or classes used by computer programs to request services from other service providers or programs.

In simpler English, an API works by communicating with and exchanging data with other systems. It acts as a messenger between the user and the system. It helps to retrieve the necessary data the user is requesting from the system.

About Flutterwave

Nigerian entrepreneurs Olugbenga Agboola and Iyinoluwa Aboyeji co-founded Flutterwave in 2016. Before establishing Flutterwave, both men had acquired an extensive entrepreneurial experience.

Olugbenga contributed to the development of FinTech solutions at a number of tech companies and financial institutions such as PayPal, Standard Bank, among others. Iyinoluwa was one of the co-founders of Andela—a company that helps organise African software developers for global companies.

They designed the digital payment system to make it easier to do business across Africa. The idea for Flutterwave came when they identified the problem of online payments in Africa. This was one of the reasons why the API allows users to make international payments in their own currencies.

Flutterwave takes care of integrating banks and payment-service providers into its platform so businesses don’t have to take on the expense and burden.

The platform does much to aid intra-continental online transactions. Also, they make it easier for global companies to receive payments from Africans considering the relatively low usage of credit cards in the continent.

Flutterwave has two major branches – Rave, its payment gateway API and Barter, its international bill payment and transfer app.

Growth and funding

Flutterwave headquarters is located in San Francisco, California where it was founded. Today, the company has offices in 10 African countries including Nigeria, Kenya and South Africa.

They have strategically maintained San Francisco as their base to have easier access to funding. Aboyeji opined that many investors would be sceptical about funding an unknown startup out of Nigeria.

The startup graduated from Silicon Valley elite accelerator program Y Combinator counts. Social Capital and Omidyar Network are also among some of its investors.

The company is funded by 32 investors and has raised a total of $64.5M in funding over 11 rounds. Their latest funding was on 21 January 2020 from a Series B round. The total amount raised in that round alone was $35M. FIS and 9Yards Capital are among the most recent investors.

Flutterwave has a post-money valuation in the range of $100M to $500M as of 21 January 2020, according to PrivCo.

According to company data, in 2019, Flutterwave processed 107 million transactions worth $5.4 billion.

Partnerships

As Flutterwave’s reputation and reach has grown over time, their partnership with other brands has increased. Here are a number of some of its most notable partnerships.

Alibaba/Alipay

In July 2019, Flutterwave partnered with Alibaba’s payment system—Alipay. The agreement made Flutterwave the payment gateway that was the link between the $200billion China-Africa trade.

Visa

Flutterwave partnered with Visa in January 2019. This partnership led to the creation of a customer payment product called GetBarter. GetBarter facilitates personal and small merchant payments across Africa.

Existing Visa card users can send and receive funds at home while non-visa card users can create virtual cards. The product has been renamed Barter.

Flutterwave’s partnership with Visa also makes it possible for users of the platform to create virtual cards that can be used for transactional purposes.

BetWay

On 4 September 2020, Flutterwave signed a partnership with British Gaming Company Betway. The partnership makes it easier for African customers to fund their BetWay wallet.

In February 2020, Google announced a partnership with Flutterwave and the training of 5,000 merchants. The focus of the training is the digital skills the merchants need for their businesses to grow.

Paga

Also in February, Flutterwave made one of its most promising indigenous partnerships with Paga. This partnership opened Paga merchants and customers to Flutterwave’s merchant base of airlines, media outfits, hotels, ticketing companies, fashion retailers, etc.

Flywire

Flutterwave also has a partnership with Flywire Payments Corporation. They provide similar services of payment gateways for international transactions in local currency. However, Flutterwave is bridging the gap of the African market to them.

Worldpay

Again, in January 2020, Flutterwave partnered with global payment system, Worldpay. This partnership made Flutterwave its payment gateway of choice in Africa. This means that a predominantly European company can easily accept payments from Africa with “indigenous” cards.

How to register on Flutterwave

Signing up for a Flutterwave account is fast, easy and free. First, you go to Flutterwave signup page and fill the form accordingly.

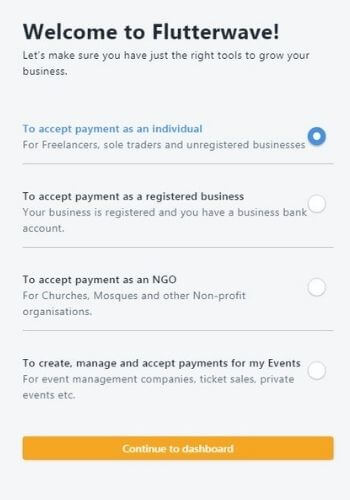

On the next screen, you select what kind of activities you want to run with Flutterwave. You can either signup as an individual, a registered business, an NGO or event management.

- Individual accounts are used for Freelancers, sole traders and unregistered businesses.

- Registered business accounts are for users who have a business bank account.

- NGO accounts are allocated for churches, mosques and other non-profit organisations.

- The event management account can be used to create, manage and accept payments for Events.

Next, you would need to verify your personal and business information.

- First, you would have to verify your phone number using a One-Time Password.

- Then, you would need to verify your company’s registration with valid details.

- You must ensure that the name on your CAC certificate corresponds with what you fill into all the forms for easy verification.

- You would also need to verify the account number into which your payments would be deposited.

- Finally, an authorised representative would need to be assigned to the account and this person must have a valid Bank Verification Number (BVN).

Features and services offered by Flutterwave

Checkout

One of the most basic services that Flutterwave offers is the Checkout option. This gives customers the option to make payments seamlessly on your website or mobile app.

Flutterwave’s checkout can be integrated into Android, iOS and web apps. It is also compatible with eCommerce stores like WooCommerce and Shopify.

Also, Flutterwave provides POS services, which can be used for offline checkouts.

Checkouts on Flutterwave can be done via a variety of methods. You can use credit or debit card payments, bank account payment, mobile money, QR Code, Bank Transfer or Unstructured supplementary service data (USSD).

With Flutterwave, your checkouts are not limited to local customers. This is because you can receive payments in over 150 local currencies, including Naira, Dollars, Pounds, Euro and Yuan.

Card issuing and management

Using Flutterwave, users can also create virtual debit cards. These cards work just like your physical debit cards and can be customised to easily fit your needs. The virtual cards are Visa and MasterCard virtual cards meaning they can be used on almost every website on the internet.

Cards can be created for the use of individuals or teams. You could also tailor the cards to be used for payment only on specific sites, and add spending limits if you wish.

All transactions done with these virtual cards can be monitored on your dashboard.

Store

Flutterwave also provides store services to users. With Flutterwave stores, you can easily set up an e-commerce platform for selling your goods and services.

To use the store service on Flutterwave you do not need to set up an extra account, your default Flutterwave account would suffice. Also, there are no extra charges for this service.

All you need to do is to log in or signup to a Flutterwave account. Next, click on “Store” on your dashboard and create a store. Now, you can add products, descriptions and images as you desire.

Another huge perk of Flutterwave stores is that you have access to Flutterwave’s delivery partners. This saves you the hassle of delivery setups.

Invoices/payment management

Flutterwave also lets you manage, create and send professional looking invoices. These invoices can be sent to your customers via email or Whatsapp. This is one tool that can help boost the trust your customers have in your brand. These invoices are available in multiple currencies.

You can also keep track of payments easily from your Flutterwave dashboard. Here, you can make sales and tax calculations. You can also track payments and overdue invoices.

Furthermore, Flutterwave’s payment management system lets you send automated reminders to customers on due payments. These reminders can be in the form of text messages or emails and are customizable.

Payment links

As beautiful as the Checkout feature that Flutterwave provides is, not everyone can afford to have an app or website. Also, there is a requirement of programming skill to use it. This is where payment links come in handy.

Payment links allow users to receive payments easily without any websites or integrations. All you need to do is create payment links and send them to your customers. Once they make payments, it reflects on your dashboard automatically.

This option makes it possible for those who have zero coding experience to still enjoy the benefits of Flutterwave. You can customise these payment links to suit your business needs.

There are three major kinds of payment links that can be created using Flutterwave:

- Single Charge – These are payment links created to receive a one-time payment from your customer. You can modify the default currency as needed.

- Subscription Link – You can use this kind of link for recurring payments or payment plans. It gives you the flexibility of choosing the number of times to charge a customer and the interval.

- Donations – You can use this kind of payment link to receive one-time donations for your charity or cause. It is like the single charge payment in the way it works.

How to use Flutterwave

To integrate Flutterwave into your website, you would need some programming knowledge—specifically Javascript. To learn the integration method, you should take a look at the exhaustive documentation provided by Flutterwave to help you to properly integrate your website and the technology.

However, for users who can’t code and don’t want to hire someone to do it for them for reason, the Payment Links option is easy to use. You have the option of creating a link for payment. This link can be dropped within your website and sent to prospective clients/customers/contributors.

Pricing

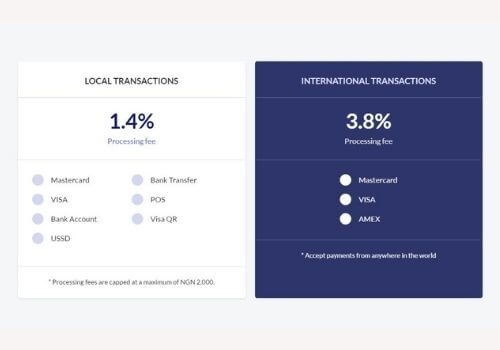

Most of Flutterwave’s products and services are available free of charge. The only time charges are made to users are when payments are made into their accounts. The charge on these transactions is known as Processing Fee.

The processing fee differs for local and international transactions. On Locally made transactions you get charged 1.4% for each transaction. International transactions carry a 3.8% processing fee. On local transactions, the maximum you can be charged per transaction is N2,000.

By default, transaction charges are borne by your customers. These charges are automatically integrated into the prices they are to pay. However, you can change this setting on your dashboard and pay the charges yourself, if you prefer.

Barter by Flutterwave

Barter by Flutterwave is a mobile app for people to create virtual cards for their online transactions or to send money within their friendship circles. Also, people looking for a more convenient way of paying bills can take advantage of the services offered by Barter.

It allows you to create a US dollar card, funded in your local currency. This card can then be used for global payments, subscriptions, etc

Money can also be sent across borders to other Barter users easily.

You can also send or buy airtime and pay bills for yourself and others using the Barter app.

Barter is available on the Google and iOS app stores. A desktop version is also accessible here.

Conclusion

Flutterwave is undoubtedly one of the pace-setting corporations in Nigeria. The company is revolutionizing the fintech environment in the country while also making life easy for both merchants and customers.

One of the company’s key strength is the wide range of partnerships the company has forged. The uniqueness of their service allows them to seamlessly provide services that other African Fin-tech startups might struggle to do.

Have used Flutterwave’s services before? Tell us about your experience in the comments below.

This is really insightful.

Interesting read