Once your salary comes in, does the expenses you have been putting off for most of the month suddenly become a more crushing weight? Wait! Before spending a dime, try these easy-to-use apps to track your spending, save more and upgrade your financial life.

Technology has placed the world at our beck and call. With these electronic devices called smartphones, tabs and computers, we almost need not move an inch to get things done anymore. Personal digital assistants, as I like to call them. There is hardly anything that can’t be done with a few taps on the screens of our smartphones.

Students can read books, writers can create their content, chefs can access recipes, languages can be learnt, job hunters can hunt, skills can be acquired, financial and commercial transactions can be made, among a million and one other things. It is an endless stream of resources. So, it is only right that money management can be easily done, on a mobile device from anywhere.

Imagine what a monthly expense tracker can do for you. An app that records your transactions, alert you of everything that goes on with your finances, helps you regulate your spending, and aids with savings. Imagine how much easier such a resource can make your life.

If you didn’t know of any already, or you have had a hard time deciding which to use, this piece is for you. We have put together a list of the 10 best expense trackers that can serve you either personally, or as a business owner.

1. Mint

Mint is a personal finance management app that helps you keep and manage all of your accounts in one place. It allows you see your expenses, account balances, monthly spending, loans, investments and much more all in one place with just a few taps. You can personalise the app’s features with the help of insights provided in-app and monitor your cash flow and savings. The app helps you with better budgeting, tax refund tracking, stay focused on your saving goals, and even prepares your credit score for free. With 24 million users across the globe, it is no doubt that Mint has wide acceptance and is trusted. Here’s the best part; the app is free!

Read more: Basic steps to investing in bitcoins for first timers.

2. YNAB

You Need A Budget!, that’s what YNAB stands for. And as the name implies, the platform is designed with the philosophy that households should spend only the money they have currently available. YNAB has a feature that allows you to see real-time updates of your budgets across all devices. It also helps you create a debt repayment plan, track progress on your financial priorities and shows you observable patterns in your spending. The app is, however, not free. Though it gives 30-day free trial access, a subscription is $11.99 per month or $84 per year for the annual plan.

3. Simplifi by Quicken

The Simplifi app allows people to link and sync an unlimited number of bank, credit card, loan and investment accounts from more than 14,000 financial institutions. The app can automatically detect regular bills and recommend a personalised spending plan. Users can also set up a watch-list for monitoring certain categories of spending, such as dining out, and receive alerts when their spending reaches a certain level. You can also set and achieve personalised financial goals on the app.

Simplifi by Quicken is ad-free, and users pay $3.99 per month or $35.99 when billed annually. A 30-day free trial is available.

4. SupportPay

SupportPay is a specialised expense tracker created for parents who share the cost of raising a child but don’t live together. With SupportPay, parents can upload or take a photo of receipts to share with the other parent. Payment can be made directly through the app, or payment records can be added manually. There is also the option for a parent to dispute an expense and provide a written explanation of why they don’t agree with the payment request. Data from SupportPay can be exported and used to create certified records that can be used for tax or court purposes.

There is a free version with limited features, but premium features cost $7.99 a month or $79.99 when billed annually.

5. PiggyVest

The Piggyvest platform uses the traditional, simple saving idea of a piggybank. It gives you the option to use the ‘piggybank’ feature to reach personal savings goals faster. It does this by a number of rules and regulations that you must adhere to or risk being penalised during the specified saving period. There are other features for various purposes such as ‘Target Savings’ which helps you save for multiple goals like holidays, fees, and special events, ‘SafeLock’, which secures your funds by locking it until a pre-selected date; this helps avoid impulsive spending.

There is also the opportunity to invest in businesses with little amounts you can afford. Every investment option is secure, and you can always monitor the progress of your investment. Piggyvest also lets you save in dollars with its Flex Dollar option. It is a Nigerian app, accepts all Naira debit cards, and you can use it free of charge.

6. Digits

Digits is better suited to entrepreneurs who want to manage their cash flow better. It provides real-time analysis of transactions to identify recurring expenses, predict future costs and detect anomalies in a business’s spending. More than 9,000 financial institutions are supported by the app, which will also automatically reconcile transactions against your bank account. The developers say the app gets smarter with every transaction. Digits is available free of charge.

Also read: Best bitcoin trading secrets for maximising profits you should know.

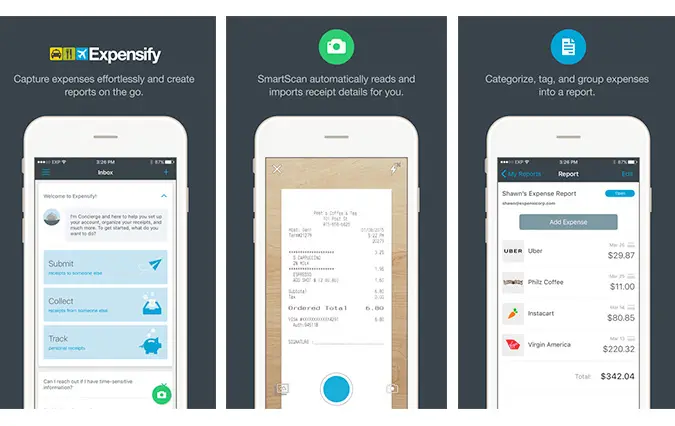

7. Expensify

Expensify was originally developed to make it easy to analyse expense reports. It is software that allows individuals and businesses to track and file expenses such as electricity, travel, utilities etc. By snapping receipts of transactions, the software uses artificial intelligence to identify the details of the transaction and automatically categorises and saves the expense. Expensify also allows you to download these reports based on user transactions. The product offers two payment options for individuals and organisations; for either annual subscriptions. It is free for up to 25 SmartScans per month, and prices for individual plans start at $4.99 a month.

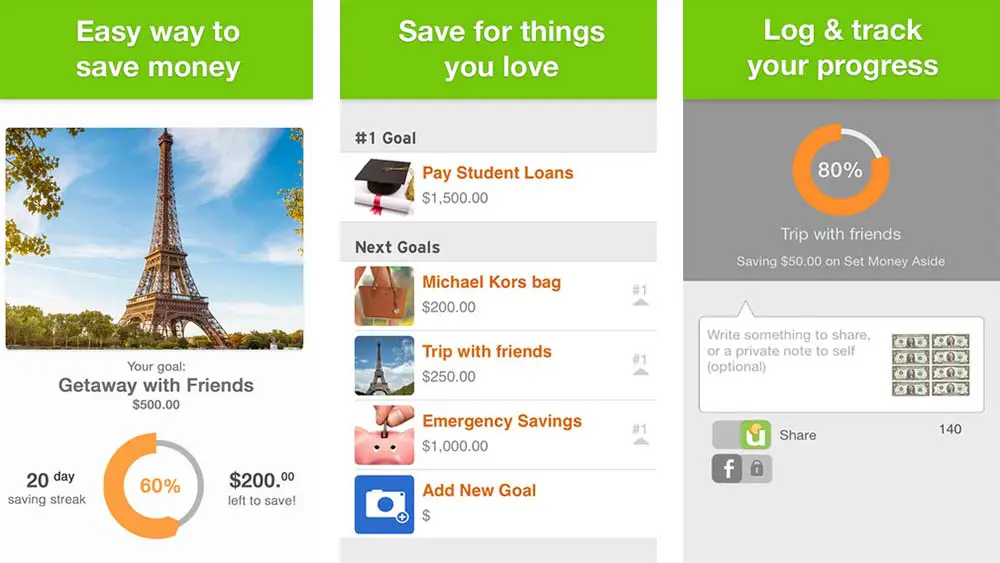

8. Unsplurge

We are all culprits of impulse spending now and again. Unsplurge, was created to aid self-discipline in that regard. It is built to encourage you to save money by working on your goals. There is no limit to the number of goals you can decide to save money for. You can also get inspiration and encouragement from family and friends as they cheer you on and share their success stories as well. The app is free and only available on iPhone.

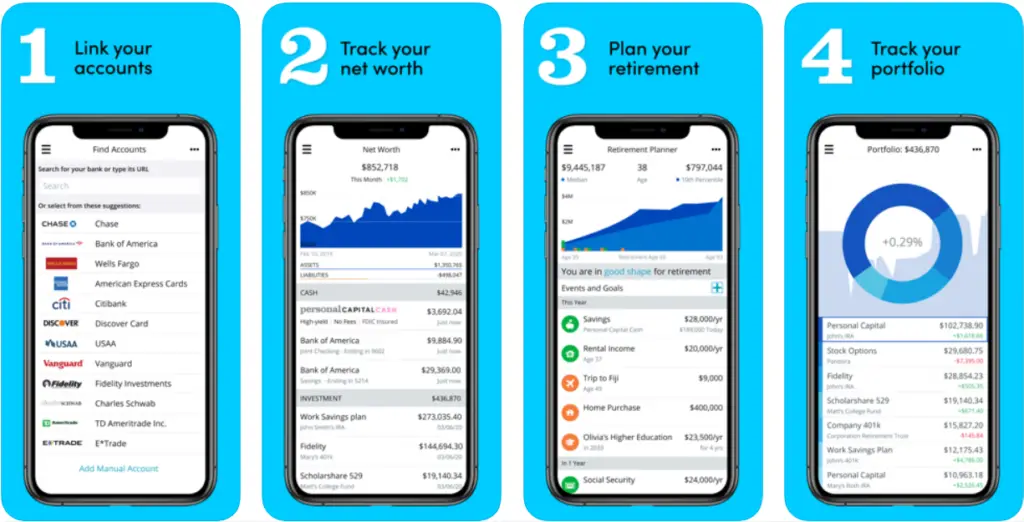

9. Personal Capital

Personal Capital has two major functions, a free personal money manager and a paid investment management service. The free function allows you to monitor your income, assets, expenses, and investments from a single portal. It helps you get investment advice on how to optimise and make more money. The paid version, which is also known as the Wealth Management program, offers a more personalised portfolio management.

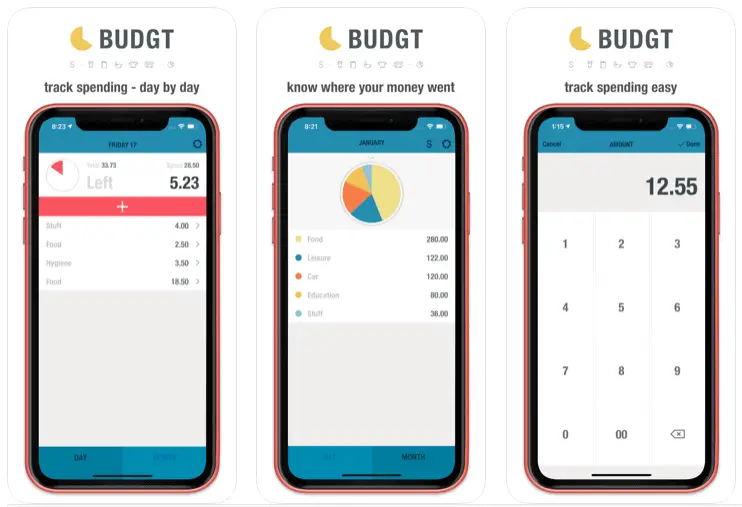

10. BUDGT

The Budgt app helps you manage your finances on a day to day basis. It calculates a daily budget based on how much you’ve already spent during any given month. The app also breaks your spending down by category so you can see and compare your expenses on leisure against necessities.

Conclusion

There is something for everyone on this list. Be you an entrepreneur, small business owner, or just an individual who is seeking better financial management. You can make your choice between the free and paid options, according to your pocket. The best way to not lose money is by being in control of how one spends it. I’m sure if you take a moment to look back, you can easily identify unwise expenses in the past that could have saved you lots of money. Take charge of your finances with any of these apps today, and see how much your life changes.

You may also like to read our latest article, Top 10 Nigerian FinTech companies and Nigeria’s Okra secures $3.5M in Susa Ventures-led Seed Round.

Interesting